Denise Carter, DCision Consult

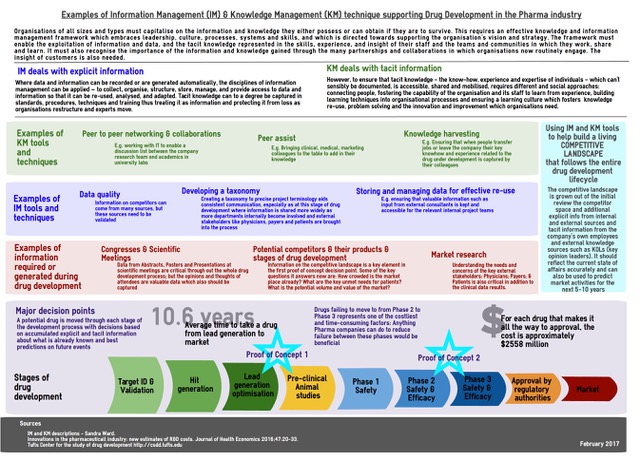

Drug development in the pharma industry is a long and expensive process, and for every drug that actually reaches the market there are multiple drugs, which also cost an enormous amount of money to develop, whose programmes were stopped. Leveraging Information Management (IM) and Knowledge Management (KM) techniques and tools improve the information that supports the drug development process, and is vital in enabling best-quality decisions.

The development of new drug from discovery to eventual marketing takes approximately 10 years of investment, (1) and the total costs have been estimated at USD $2,558 million (2). A 2011 U.S. study (3), which looked at drugs developed between 2004 and 2010, found that the overall success rate for drugs moving from early stage Phase I clinical trials to U.S. FDA approval is about one in 10. The largest dropout rate along the clinical pathway came in advancing drugs from mid-stage Phase II studies to late-stage Phase III testing. Some 63 percent of drugs in Phase I testing advanced to Phase II, but only 33 percent of Phase II drugs made it to Phase III. This phase is typically the final stage of human testing before a new drug is submitted to regulators for an approval decision, and requires a commitment to larger and much more expensive clinical trials.

Clearly, the more a pharmaceutical company can do to reduce the time for each stage, and most critically the chances of success for each phase, the more their competitive advantage Is enhanced.

Information plays a key role in this. The following infographic describes just a few of the information management and knowledge management tools and techniques which are regularly employed in the pharmaceutical industry to support the drug development process.

Capturing and using information from the very early stages of a project is essential. During my time as an Information Manager for a mid-sized biopharmaceutical company, my team worked very hard to make sure we were at least part of the ad-hoc team members for the project team as soon as a drug reached the lead-generation optimisation stage of the development process. At this stage, normally the project team will begin to assess the relative merits of several indications (diseases) for which the candidate could have an effect, given its mechanism of action.

The criteria for selection for continued development by the company are usually weighted towards commercial factors, such as potential patients being able to pay for the eventual drug, sales and distribution channels already in place or easy to adapt. Unmet needs for patients and physicians in treatment is, of course, also a high consideration. Ideal would be a drug that is either first-to-market, i.e. there are no current disease modifying drugs available to treat this indication, or first-in-class if there are current treatments; but the new drug would have a different mechanism of action and would be able to offer superior efficacy and/or safety. Therefore required to make effective decisions are: information on the number of patients, their age, gender, race, geographic distribution; the current competitor landscape – how many drugs are marketed? How many drugs are in development? At what stage of development? Timelines? – The commercial value: would the availability of a new drug be viewed as cost-effective by prescribers and those who reimburse for drugs?

After the initial phases of animal and human studies (Phase I) and additional information about the potential market is further understood, the drug is usually either pursued in one or potentially two indications, but one is usually prioritised.

As the drug continues clinical testing, the clinical and medical information gathered from the trials is also combined with the commercial information, with increased collaboration with the information and knowledge teams working in the organisation. More teams are involved internally, such as the clinical team who design the clinical trials, the marketing team who begin to assess how to position the drug in the marketplace, the market research team who begin to reach out to physicians, payers and patients, as well as other external voices, such as key opinion leaders (key scientific and medical physicians or scientists working in the indication).

The quantity of information increases at an enormous rate, and ideally it all needs to be captured, quality-checked, synthesised and effectively packaged so it can be re-used. Effective communication between all parties needs to be established, on one level so that everyone is aware of what information is being captured or generated, and by whom, and on another level to ensure that terminologies used are consistent so that the same thing is understood by everyone involved. The reality is more often than not, unfortunately, a little different.

My personal experience was that the more IM and KM tools that our information team could implement, the more value the organisation found in our team’s activities, although sometimes that acceptance was slower than I would have liked. Some concrete results were being invited to participate much earlier in project life-cycles, and being asked to contribute directly (rather than via a third-part) to the key reports used by the company decision committees.

References

(1) Innovations in the pharmacuetical industry: new estimates of R&D costs. Journal of Health Economics 2016;47:20-33.

(2) Tufts Center for the study of drug development http://csdd.tufts.edu

(3) http://www.reuters.com/article/us-pharmaceuticals-success-idUSTRE71D2U920110214 accessed 25Feb2017

K & IM Refer 33 (1) Spring 2017